child tax portal update dependents

Update your mailing address. To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child tax credit portal.

2021 Child Tax Credit Steps To Take To Receive Or Manage

That means that instead of receiving monthly payments of say 300 for your 4-year-old you can wait until filing 2021 taxes in 2022 to receive the 3600 lump sum.

. The soon-to-be-unveiled Child Tax Credit Update Portal will let you opt out of receiving the monthly child tax credit payments. The Update Portal for adding a dependent is not available yet. The full monthly child tax credit benefit is eligible for incomes up to 75000 for individuals 112500 for heads of household and 150000 for married couples.

In order to claim someone as your dependent the person must be. June 28 2021. Other features coming to the portal include viewing payment history and updating dependents.

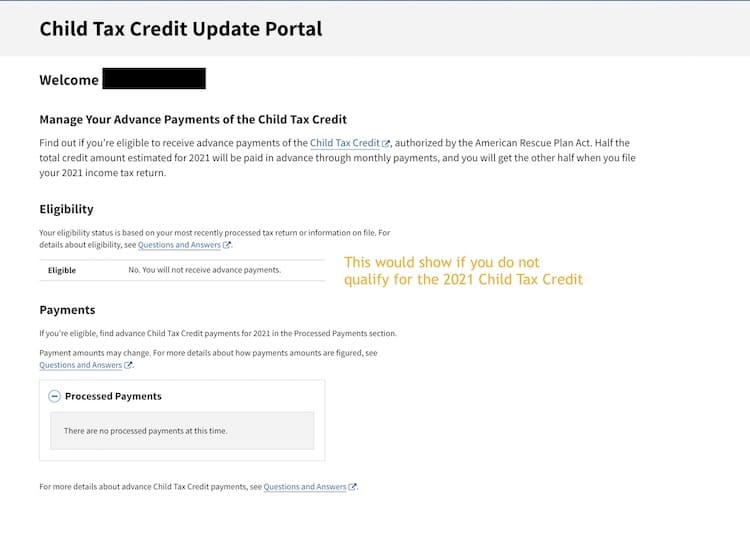

The new child tax credit CTC is currently for 2021 only. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. The CTC for 2021 increases from 2000 to 3000 for children ages 6 to 17 and 3600 for children ages 5 and under.

To access this portal users need an IRS username or an IDme. A nonfiler portal lets you provide the IRS with basic information about yourself and your dependents if you normally. Heres how they help parents with eligible dependents.

Elect not to receive advance Child Tax Credit payments during 2021. If something happens that you are unable to get the payments you can still get the full child tax credit for that child when you file in 2021. This secure password-protected tool is easily accessible using a smart phone or computer with internet.

Child Tax Credit Update Portal. The IRS launched on IRSgov a Child Tax Credit Update Portal CTC UP to allow you to. The tool also allows families to unenroll from the advance payments if they dont want to receive them.

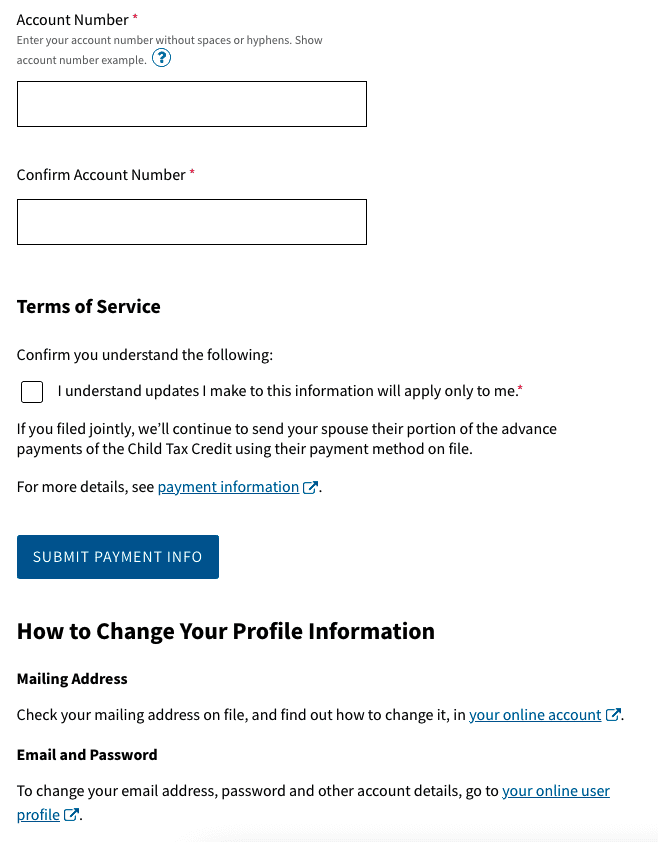

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. It begins to phase out after that. This article discusses the new child tax credit and the child and dependent care credit in further detail.

The Update Portal is available only on IRSgov. It also lets recipients view. The amounts are based upon the childs age on December 31 2021.

Update your bank account information. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving.

The IRS says it will be available later this year If you dont get all the payments for your new child during the year you will be able to claim the missing amount as a credit on your 2021 tax return. Updating the portal or any changes next year could also result in an additional payment next year if you were underpaid. You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year.

National or a resident of Canada or Mexico. Unmarried or if married not filing a joint return or only filing a joint return to claim a refund of income tax withheld or estimated tax paid. At some point the portal will be updated to allow you to update how many dependants you have.

The Child Tax Credit Update Portal now also allows users to add or modify bank account information for direct deposit. Child Tax Credit Update Portal. Either your qualifying child or qualifying relative.

The updated information will apply to the August payment and those after it. Once that functionality is available you can use the Child Tax Credit Update Portal to submit your new dependents information to the IRS and update your payment amount. The Child Tax Credit Update Portal allows taxpayers to make sure their household information is correct check payment status and unenroll from the.

See Q F3 at the following link on the IRS web site.

2021 Child Tax Credit Steps To Take To Receive Or Manage

Irs Website Has Tool To Update Direct Deposit Info For Child Tax Credit Cpa Practice Advisor

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Steps To Take To Receive Or Manage

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back